Making a mobile app for banking software might lead to a plethora of chances in the rapidly developing fintech industry. Applications from companies like Temenos, Fiserv, Jack Henry & Associates, and FIS Global are redefining how consumers engage with banks. However, how much does it really cost to create a banking app this strong, safe, and expandable?

We’ll dissect the several elements that affect the price of creating a mobile banking app in this blog article. We’ll also cover topics like selecting the top mobile app development business, app development tools, and the significance of responsive design in producing distinctive mobile applications.

Key Factors Influencing the Cost of Banking Software Mobile App Development

The cost of developing a banking software mobile app is influenced by several factors, including the app’s complexity, the platforms it will run on, security requirements, and the experience level of the development team. Below, we explore the primary factors in detail:

1. App Complexity

App complexity plays a pivotal role in determining the overall cost. Simple apps with basic features (such as account balance checks or transaction history) will cost significantly less than complex banking apps with advanced functionalities like:

- Mobile deposits

- Fraud detection systems

- Peer-to-peer transfers

- Real-time notifications

- AI-powered chatbots for customer support

Typically, a more complex app, like those offered by FIS Global or Temenos, will demand a higher investment in development.

2. Development Platforms

The choice of platform also impacts the cost. Developing a banking app for a single platform (either iOS or Android) costs less than building a cross-platform app. However, most banks today prefer to develop apps that work seamlessly on both platforms to cater to a larger audience.

- Native App Development: Separate apps for Android and iOS result in high costs due to individual development efforts.

- Cross-Platform App Development: Using frameworks like React Native or Flutter allows you to develop a single codebase for both platforms, reducing costs.

Many mobile app development companies recommend mobile app development with React because of its efficiency in creating cross-platform apps without compromising quality.

3. Security Features

Banking apps handle sensitive data, so robust security measures are critical. The security features needed to protect users’ information (e.g., two-factor authentication, encryption, tokenization, and biometric authentication) significantly add to development costs.

Compliance with regulations like GDPR, PCI DSS, and AML (Anti-Money Laundering) is non-negotiable for banking software mobile apps. This additional layer of security ensures the app meets both local and international standards.

4. User Interface (UI) & User Experience (UX) Design

The app’s UI/UX design is another key factor. A seamless, intuitive user experience will encourage customers to engage more frequently with the app, while poor design can result in negative reviews and low adoption rates.

Investing in mobile app responsive design ensures that your app functions flawlessly across various devices and screen sizes, providing a consistent user experience whether customers access it on smartphones or tablets. Apps with custom design and a focus on superior UX, like Jack Henry & Associates’ apps, tend to be more expensive due to extensive design research and iteration.

5. Team Size and Expertise

The cost of hiring a mobile app development company will also depend on the expertise and size of the team. High-quality teams with experience in fintech app development charge higher rates, but they are more likely to deliver secure, scalable, and successful products.

Key team members needed for your banking app development include:

- Project Manager

- Business Analyst

- UI/UX Designer

- Frontend Developer

- Backend Developer

- Quality Assurance Tester

- Security Specialist

Many businesses prefer partnering with a mobile app development company near me to simplify communication and collaboration. However, outsourcing to offshore development teams can also reduce costs while maintaining high quality.

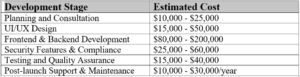

Let’s take a look at a rough estimate for developing a banking software mobile app, keeping in mind the various factors outlined above. The actual cost will depend on the specific features, platforms, and security requirements.

These figures reflect the typical costs associated with hiring a professional mobile app development company that specializes in fintech software. Depending on the complexity and scale of your app, costs can range from $150,000 to over $400,000 for the complete development process.

Features that Can Add to the Development Cost

To ensure your app stands out from the competition, it’s important to invest in advanced features. Here are some additional functionalities that can increase your app’s cost:

- AI-Powered Personalization: Implementing machine learning algorithms that suggest financial products or offer tailored advice.

- Blockchain Integration: Ensuring secure and transparent transactions by integrating blockchain technology.

- Voice Banking & Chatbots: Enabling customers to interact with your app using voice commands or AI-driven chatbots.

- Integration with Third-Party APIs: Features like payments, loan calculators, or currency converters require API integrations, adding complexity to the development.

Choosing the Right Mobile App Development Company

Selecting the right mobile app development company is critical for a successful project. Whether you’re developing an app from scratch or enhancing an existing one, here’s what to look for:

- Experience in Fintech: Choose a company with proven expertise in fintech app development and knowledge of industry regulations.

- Portfolio: Review their previous work, particularly their experience with apps similar to FIS Global, Fiserv, or ACI Worldwide.

- Technology Stack: Ensure the company uses cutting-edge technologies, such as React Native for cross-platform apps and cloud-based infrastructure for scalability.

- Post-launch Support: A great app development company will offer continuous support and maintenance after the app is live to ensure security updates and bug fixes.

Many successful businesses prefer working with mobile app development companies that specialize in mobile app development with React for fast, high-quality solutions.

Reducing Costs Without Compromising Quality

While developing a banking software mobile app can be costly, there are ways to reduce the expenses without sacrificing quality:

- Use Pre-built Components: Instead of building every feature from scratch, leverage existing APIs and third-party integrations to save time and money.

- Cross-platform Development: Choose cross-platform development tools like React Native to reduce time and effort while maintaining a native-like performance.

- Outsource to Offshore Teams: Offshore development companies, particularly those in regions like Eastern Europe or South Asia, often offer highly skilled developers at more affordable rates.

Understanding the Technology Stack for Banking Mobile App Development

The choice of technology stack is pivotal when developing a banking software mobile app. It determines how well your app performs, its scalability, security, and overall user experience. When looking at apps from fintech leaders like FIS Global, Fiserv, or ACI Worldwide, you will notice that their apps are built on a modern, robust tech stack designed for performance and security.

1. Frontend Technologies

The frontend of your app is what users interact with. Ensuring a seamless, responsive, and intuitive user interface is critical for customer retention. For banking apps, speed, clarity, and simplicity are key.

- React Native: Many mobile apps today are built with React Native for cross-platform development. It allows developers to use a single codebase to build apps that work on both iOS and Android, reducing time and cost without sacrificing performance. React Native is particularly suited for fintech apps that need to maintain high performance and responsiveness.

- Flutter: Another popular choice is Flutter, which, like React Native, allows for cross-platform development. It’s known for delivering a smooth user experience with fast loading times and less lag, critical for apps handling financial transactions.

2. Backend Technologies

The backend is the engine that powers your mobile banking software app, processing transactions, storing data, and ensuring communication between the frontend and the database.

- Node.js: This is one of the most widely used backend technologies for mobile app development, known for its ability to handle multiple requests at once, which is ideal for banking apps that may have millions of active users. Its asynchronous architecture ensures faster processing of requests.

- Python/Django: Python is often chosen for fintech applications due to its simplicity and robustness. The Django framework offers built-in security features such as protection against SQL injections and cross-site request forgery (CSRF), which is crucial for banking software.

- Java: Used in large-scale financial applications, Java provides a secure and stable environment for banking transactions. It is highly scalable, making it a good choice for apps that need to handle millions of concurrent transactions.

3. Database Solutions

The choice of a database depends on the type of data and the number of transactions the app needs to handle. Financial apps need to store vast amounts of sensitive data efficiently while maintaining security.

- PostgreSQL: This open-source relational database management system is known for its performance and flexibility. It supports complex queries and handles large data volumes, which is essential for fintech apps.

- MongoDB: If the app needs to handle large amounts of unstructured data, MongoDB might be a better fit. It is a NoSQL database that allows for more flexibility in data handling, which can be beneficial in certain banking app scenarios, such as real-time analytics or customer behavior tracking.

- Oracle: For enterprises that require extreme reliability and compliance with banking regulations, Oracle databases are often used. They offer strong performance, scalability, and security features tailored for financial institutions.

Security Measures for Banking Software Mobile Apps

Security is one of the most critical aspects of developing a banking software mobile app. Users need to trust that their personal and financial information is safe. Ensuring that your app complies with the latest security standards can increase the development cost, but it is essential to avoid data breaches and regulatory fines.

Here are some key security measures that should be incorporated:

1. Data Encryption

All sensitive user data, including personal identification information (PII) and financial data, must be encrypted both at rest and in transit. End-to-end encryption ensures that even if data is intercepted, it cannot be accessed without the proper decryption keys.

2. Multi-factor Authentication (MFA)

Banking apps should incorporate multi-factor authentication (MFA) to prevent unauthorized access. This usually involves a combination of something the user knows (password), something they have (a mobile device), and something they are (biometric data like fingerprint or facial recognition).

3. Tokenization

Tokenization is a security process where sensitive data is replaced with a non-sensitive token. This token cannot be used by anyone other than the intended recipient, making it a great choice for securing payment transactions in a mobile banking app.

4. Real-Time Fraud Detection

Real-time fraud detection systems analyze user behavior patterns and flag unusual activities, such as large transfers or logins from different locations, to prevent fraudulent activities. Incorporating AI and machine learning can help make these systems more effective by learning typical user behavior and improving detection accuracy.

5. Compliance with Industry Standards

Banking apps need to comply with industry regulations such as PCI DSS (Payment Card Industry Data Security Standard) for handling credit card information, GDPR for data privacy in the European Union, and CCPA for data privacy in California. These standards ensure that user data is handled and stored securely.

Post-Launch Maintenance and Updates

Developing and launching your banking app is just the beginning. Ongoing maintenance, updates, and feature enhancements are necessary to keep your app secure and competitive in the market. The fintech sector is rapidly evolving, and continuous improvements are essential for long-term success.

1. Security Patches

As new vulnerabilities are discovered, your app will need regular security patches. Failing to keep your app updated with the latest security protocols can leave it vulnerable to cyberattacks.

2. Performance Optimization

Monitoring app performance and addressing issues such as slow load times or crashes ensures that users have a smooth experience. Tools like Google Analytics or Firebase can be integrated to track app performance metrics.

3. New Features and Enhancements

As user expectations evolve, your app will need to be updated with new features and enhancements. Integrating new functionalities such as voice banking, personalized financial advice, or integration with emerging payment systems like cryptocurrency wallets can keep your app relevant in a competitive market.

4. User Support and Bug Fixes

Customer support is vital for resolving user issues and improving app ratings. A dedicated support team can help manage technical issues, and regular bug fixes ensure the app remains functional and user-friendly.

Final Considerations for Developing Banking Software Mobile Apps

The cost of developing a banking software mobile app depends on numerous factors, from the app’s complexity and security features to the choice of development platforms and teams. While building a fully functional, secure banking app is a significant investment, the benefits of offering a seamless, intuitive, and secure digital banking experience to your customers far outweigh the costs.

To recap, here are some of the most important aspects to consider:

- Choose the right mobile app development company: Whether local or offshore, ensure the company has experience in fintech.

- Invest in mobile app responsive design: Providing a great user experience across all devices is crucial.

- Implement robust security measures: Protecting user data with encryption, MFA, and real-time fraud detection is non-negotiable.

- Stay compliant with industry standards: Ensure your app meets all necessary regulations.

- Prepare for long-term maintenance and support: Ongoing updates and performance optimization are necessary for sustained success.

The Role of UX/UI Design in Banking App Success

A well-designed banking app can significantly impact user engagement and satisfaction, ultimately determining the app’s success. While functionality and security are essential, users expect seamless, intuitive, and aesthetically pleasing interfaces that simplify their financial tasks.

1. Simplicity and Intuitiveness

The design should make it easy for users to navigate and perform essential banking tasks such as transferring money, checking balances, and paying bills. Over-complicated design elements or too many steps for a single transaction can frustrate users, leading to poor adoption rates.

- Streamlined Navigation: Implement straightforward menus and quick access to the most frequently used features. Large buttons, readable fonts, and clear instructions contribute to a seamless user experience.

- Consistency Across Platforms: Whether users are accessing the app on an iPhone, Android device, or tablet, the user experience should remain consistent. This consistency fosters trust and ensures that users can quickly adapt, regardless of their device. Using mobile app responsive design is critical for achieving this uniformity.

2. Personalized User Experiences

Banking apps like those developed by Fiserv or ACI Worldwide are moving toward more personalized user experiences. Offering tailored content, recommendations, and services can make users feel valued and catered to individually. Personalization may include:

- Custom Dashboard: Allowing users to customize their dashboard with their preferred financial widgets like expense tracking, savings goals, and credit score monitoring.

- Personalized Financial Advice: Implementing AI to provide financial insights based on users’ spending patterns, such as advising on savings opportunities or suggesting investment products.

3. Microinteractions for User Engagement

Microinteractions, such as animations when a transaction is successful or a notification alert when a payment is due, enhance user engagement. These small but significant details contribute to a pleasant user experience, improving the overall feel of the app and making it more enjoyable to use.

4. Dark Mode and Accessibility Features

As mobile app usage increases, many users expect accessibility features such as dark mode to reduce eye strain during nighttime usage and a range of settings for those with disabilities, such as voice commands and screen readers. Accessibility not only improves user satisfaction but also ensures compliance with accessibility standards.

Mobile App Development Methodologies

Choosing the right development methodology for your banking software mobile app is essential to ensure timely delivery, quality assurance, and collaboration among stakeholders. Below are some of the most commonly used methodologies in app development:

1. Agile Development

Agile is the most popular methodology used by mobile app development companies, especially for fintech applications. It is characterized by its iterative approach, allowing development teams to deliver features in small increments.

- Flexibility: Agile allows changes in features or design based on user feedback, which is crucial for a rapidly evolving industry like fintech.

- Faster Time-to-Market: By working in sprints, teams can release an MVP (minimum viable product) quickly, gather feedback, and iterate on the app’s development.

2. DevOps Integration

Many fintech companies integrate DevOps into their development strategy to automate and streamline processes, from development to deployment and maintenance.

- Continuous Integration/Continuous Deployment (CI/CD): This practice allows for frequent updates and bug fixes, ensuring that the app is always up-to-date and running efficiently. CI/CD pipelines also help catch errors early in the development process, reducing the time and cost needed for fixes.

3. Waterfall Methodology

In some cases, particularly for projects with well-defined requirements, the Waterfall methodology may be used. This is a linear and structured approach where each phase of the project must be completed before moving on to the next.

While this method may not offer the same flexibility as Agile, it is suitable for banking apps that have very specific regulatory requirements and features that are unlikely to change during development.

Timeframe for Developing a Banking Software Mobile App

The timeline for developing a banking software mobile app like those offered by FIS Global, Fiserv, or Temenos depends on several factors, such as the complexity of features, the number of platforms being targeted (iOS and Android), and the size of the development team.

Here’s a general breakdown of the stages and the time required for each:

Thus, on average, it may take anywhere from 6 to 12 months to develop and launch a fully functional banking mobile app.

Choosing Between Off-the-Shelf Solutions and Custom Banking App Development

When developing a banking software mobile app, businesses often face a crucial decision: should they opt for an off-the-shelf solution or invest in a fully customized app?

1. Off-the-Shelf Solutions

These are pre-built banking software solutions that can be customized to a certain extent to fit your business’s needs. They typically cost less and are faster to implement, making them ideal for startups or small banks.

- Pros:

- Lower upfront costs

- Faster implementation

- Built-in compliance and security features

- Cons:

- Limited customization options

- Restricted scalability

- May lack unique branding or tailored user experience

2. Custom Banking App Development

Custom development allows for the creation of a unique banking app with specific features and branding that fully aligns with your company’s goals.

- Pros:

- Complete control over features and design

- Unlimited customization for a unique user experience

- Ability to scale and grow with your business

- Cons:

- Higher development costs

- Longer development time

- Requires a more in-depth process for compliance and security

While off-the-shelf solutions may be cheaper, they often lack the flexibility needed to stand out in a competitive market. On the other hand, custom banking app development offers a tailored experience but requires a greater investment in time and resources. Most large financial institutions, like those using apps developed by Temenos or Fiserv, prefer custom solutions to ensure a fully branded and scalable platform that meets their specific needs.

Future Trends in Banking Software Mobile App Development

As the financial technology landscape continues to evolve, certain trends are shaping the future of mobile banking app development. Here are some innovations to watch out for:

1. Artificial Intelligence (AI) and Machine Learning

AI is transforming the way banking apps function, providing enhanced user experiences through personalized financial advice, predictive analytics, and fraud detection. AI-powered chatbots are already assisting with customer support, and as AI becomes more advanced, apps will provide more intelligent recommendations based on user behavior.

2. Blockchain Integration

Blockchain technology is revolutionizing secure transactions, particularly in the area of cryptocurrency. Integrating blockchain into banking apps can increase transaction transparency, security, and speed, making it a key focus for future banking software development.

3. Voice and Gesture-Based Banking

With the rise of AI-powered voice assistants like Siri and Alexa, banking apps are beginning to integrate voice-activated services. Gesture-based navigation and controls are also gaining popularity, allowing users to perform actions with ease. This form of interaction creates a more intuitive user experience.

4. Biometric Security

While fingerprint and facial recognition are already widely used, the future of mobile banking security may involve even more advanced biometric solutions. For instance, behavioral biometrics—such as how a person interacts with their device—can add an additional layer of security beyond traditional methods.

5. Open Banking

Open banking allows third-party financial service providers to access banking data through APIs (with user consent). This promotes competition and innovation in the fintech space. Apps that incorporate open banking features will offer users seamless integrations with external services, such as budgeting tools, investment platforms, and payment processors.

Final Thoughts

The cost of developing a banking software mobile app like those created by FIS Global, Fiserv, or Jack Henry & Associates can range significantly based on complexity, features, and security requirements. Choosing a reputable mobile app development company with fintech expertise, prioritizing mobile app responsive design, and incorporating robust security features are critical for success.

If you’re considering building a banking software mobile app, it’s essential to partner with a mobile app development team that understands the nuances of fintech, delivers top-tier UI/UX, and ensures compliance with the highest industry standards. Whether you’re working with a local team or outsourcing to a mobile app development company, the investment is significant, but so are the rewards in today’s digital-first banking landscape.

Conclusion: Investing in the Future of Mobile Banking

Developing a banking software mobile app like those provided by FIS Global, Fiserv, Jack Henry & Associates, or Temenos requires significant investment but offers long-term benefits for financial institutions aiming to stay competitive in the modern market. From security to user experience, each aspect of the app must be carefully designed and developed to meet the needs of users while complying with strict industry regulations.

Working with an experienced mobile app development company ensures that your app will not only be secure and reliable but also scalable to grow alongside your business. By focusing on cutting-edge technology, top-notch security measures, and an intuitive user experience, your banking app can provide a valuable service that retains customers and builds trust.

At Web craft Pros, we specialize in developing high-quality, scalable, and secure banking software mobile apps tailored to meet your unique business goals. Reach out to us today to discuss how we can help you build a state-of-the-art mobile banking solution.